Property roi formula

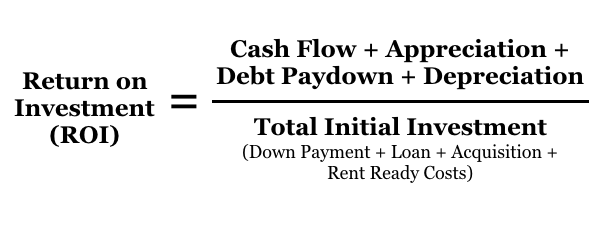

The ROI formula is based on two pieces of information - the gain from investment and the cost of investment. For instance for a potential real estate property investor A might calculate the ROI involving capital expenditure taxes and insurance while investor.

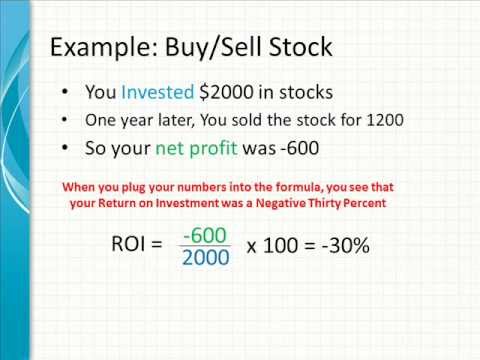

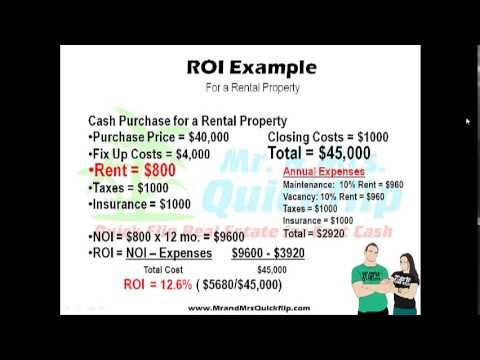

How To Calculate Roi Youtube

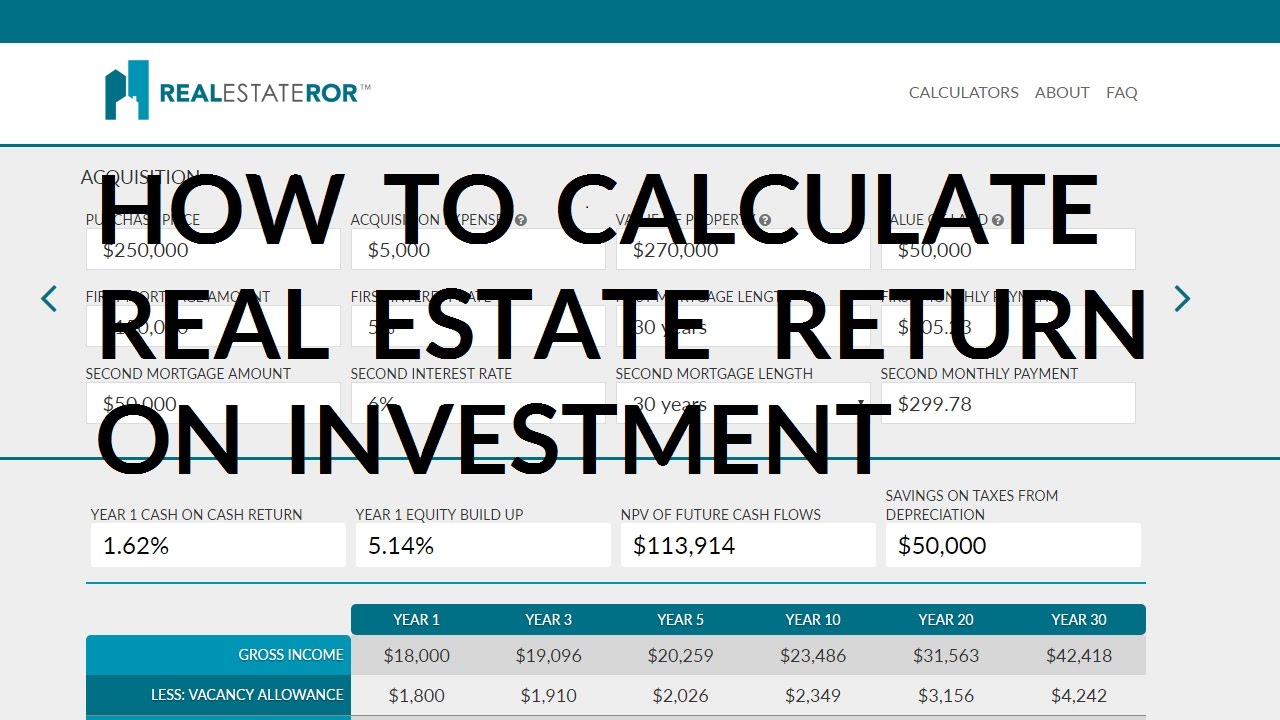

You purchase a property in New York for 600000.

. Expressed as a percentage the cap rate is always calculated using the current market value of a property. What one investor considers. The formula is simple.

Rental properties are known to yield anywhere from five to 10 percent with some investments even going. Now for calculation of Total Return and of Total Return the following steps are to be taken. For example if an investment generates annual returns of 5000 and the cost of the investment is.

A marketing manager can use the property calculation explained in the example section without accounting for additional costs such as maintenance costs property taxes sales fees stamp duties and legal costs. Our newly calculated percentage for ROI Return cell D60 will divide the Yearly Cash Flow cell D58 by the Invested Equity cell D59. You paid 100000 in cash for the rental property.

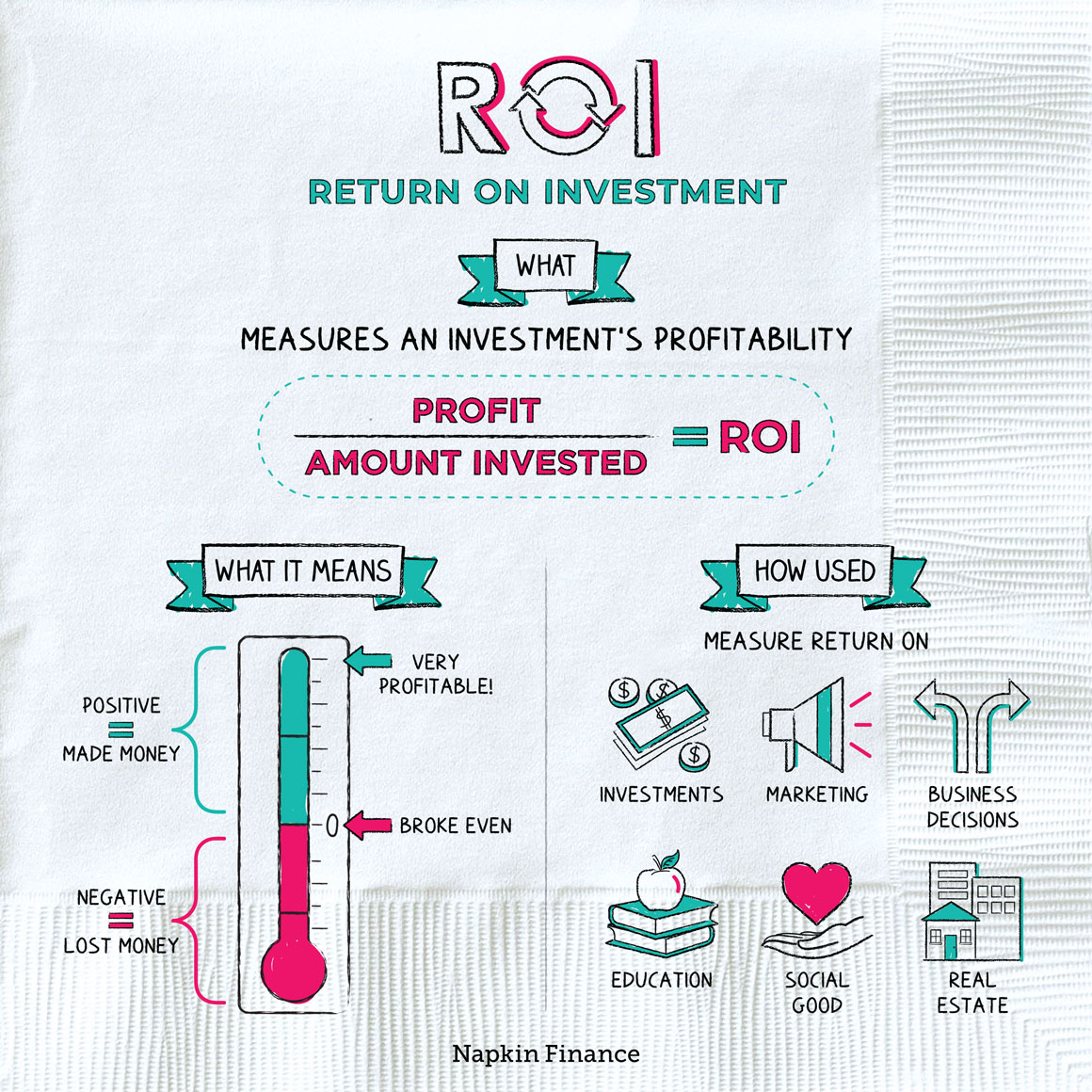

An ROI calculation will differ between two people depending on what ROI formula is used in the calculation. As a concept it can measure profitability or efficiency. Try our remortgage profit calculator.

Input just three numbers. Return on investment ROI is a metric that helps real estate investors evaluate whether they should buy an investment property and compare apples to apples one investment to another. So David has earned a return equivalent to 2 times his.

Equity Multiple Formula Present Value of the Property Amount Invested. It helps to gauge the ROI made by your own money. In this case ROI is 05 million for the investment of 15 million and the return on investment percentage is 3333.

ROI formula for rental property. Using the latest stamp duty rates. Option A might require an initial investment of 1 million while Option B may require an initial.

ROI is calculated by subtracting the initial cost of the investment from its final value then dividing this. A performance measure used to evaluate the efficiency of an investment or to compare the efficiency of a number of different investments. Return On Investment - ROI.

Then identify the final value of the investment which includes the 360000 that you receive from selling the home less any commissions taxes or fees you paid to sell the. Buy-to-let Property Profit and Tax Calculator. Like this we can calculate the investment return ROI in excel based on the numbers given.

Sommaire déplacer vers la barre latérale masquer Début 1 Histoire Afficher masquer la sous-section Histoire 11 Années 1970 et 1980 12 Années 1990 13 Début des années 2000 2 Désignations 3 Types de livres numériques 4 Qualités dun livre numérique 5 Intérêts et risques associés Afficher masquer la sous-section Intérêts et risques associés 51 Intérêts 52. Value of 9 Debentures is 90000. The ROI Calculator consists of a formula box where you enter the initial amount invested the amount returned and the investment period.

For example if sales dropped 1000 a month on average for the previous 12-month period and a 500 marketing campaign results in a sales drop of only 200 that month then your calculation. To calculate the ROI of a property take the estimated annual rate of return divide it by the property price and then convert it into a percentage. People refer to ROI when discussing what they get back for their input.

ROI Annual Returns Cost of Investment. ROI is relatively easy to calculate using the following formula. Already own the property.

Bangkok September 6 2022 Bitkub Blockchain Technology Bitkub Chain and Bitkub NFT developer invite you to open the new experience of the digital world and participate in the NFT activities at Bitkub NFT Fair event on September 10-11 at Bitkub M Social Helix Building 9th floor The Emquatier. ROI Net Profit Total Investment 100. ROI is used as a concept and a specific formula.

What Is a Good Return on Investment ROI for Real Estate Investors. ROI Total Return Initial. The ROI Calculator shows you the total gain on investment.

Return on investment ROI is an approximate measure of an investments profitability. Is a formula used to calculate the value of an investment deal. Calculate yield ROI profit required investment stamp duty available mortgage and more.

Return on investment ROI or return on costs ROC is a ratio between net income over a period and investment costs resulting from an investment of some resources at a point in time. The basic formula to calculate ROI is. To calculate the ROI below is the formula.

Calculating a propertys ROI is fairly straightforward if you buy a property with cash. To calculate return on investment you should use the ROI formula. One ROI formula is ROI Net return on investment Cost of investment x 100.

The most common way to measure an investment deals relative success is the. 52219100000 100 5222. Thats pretty good over the long term.

The property is then often sold to an investor who will complete a full rehab. ROI allows investors to predict based on comparables the profit margin they should realize on their real estate either through flipping homes or renting properties as a. A high ROI means the investments gains compare favourably to its cost.

This yields a value of 185. The formula for NPV doesnt distinguish a projects size or give favorability for higher ROI. With the value of the property at 200000 your equity position or potential profit is 130000.

Can the net harness a bunch of volunteers to help bring books in the public domain to life through podcasting. Three years later you sell this property for 900000. You can efile income tax return on your income from salary house property capital gains business profession and income from other sources.

If you have taken debt and it has helped increase the return then this multiple will increase. This means that for every dollar we invest we are receiving an additional 185. LibriVox is a hope an experiment and a question.

First calculate the equity multiple of the property. At the time of purchase the property value of your home was appreciated at 300000. As a performance measure ROI is used to evaluate the efficiency of an investment or to compare the efficiencies.

While the ROI formula itself may be simple the real problem comes from people not understanding how to arrive at the correct definition for cost andor gain or the variability involved. Total Return Formula Example 2. Then after two months you sold it for 2 million.

Heres an example of a rental property purchased with cash. Take the generated income and subtract the total operating costs. However ROI is a true metric that can be calculated as a ratio or percentage.

Expected price repair cost and the monthly rent. The equation that allows calculating ROI is as follows. ROI measures the amount of.

The value per share of PQR Ltd is 700.

How To Calculate Roi On Rental Property Rapid Property Connect

How Do You Calculate Return On Investment On Rental Property

4 Ways Passive Investors Can Calculate Roi In Real Estate

How To Calculate Roi For A Potential Real Estate Investment Excelsior Capital

What Is A Good Return On Investment For Rental Properties Mashvisor

4 Ways Passive Investors Can Calculate Roi In Real Estate

Return On Equity Denver Investment Real Estate

Quick Flip Quick Tip Calculating Roi Net Profits In Real Estate Youtube

How To Increase Roi On A Rental Property Mashvisor

5 Easy Ways To Measure The Roi Of Training

Calculating Returns For A Rental Property Xelplus Leila Gharani

How To Calculate Roi On Spanish Rental Property

How To Calculate Roi On Rental Property Rapid Property Connect

Roi In Real Estate How To Calculate Roi On Property 99acres

How To Calculate The Return On Investment Roi Of Real Estate Stocks Youtube

Roi Formula Calculate Roi And More From Napkin Finance

Calculating Returns For A Rental Property Xelplus Leila Gharani